Borrower Beware

The Ins and Outs of Student Loan Debt

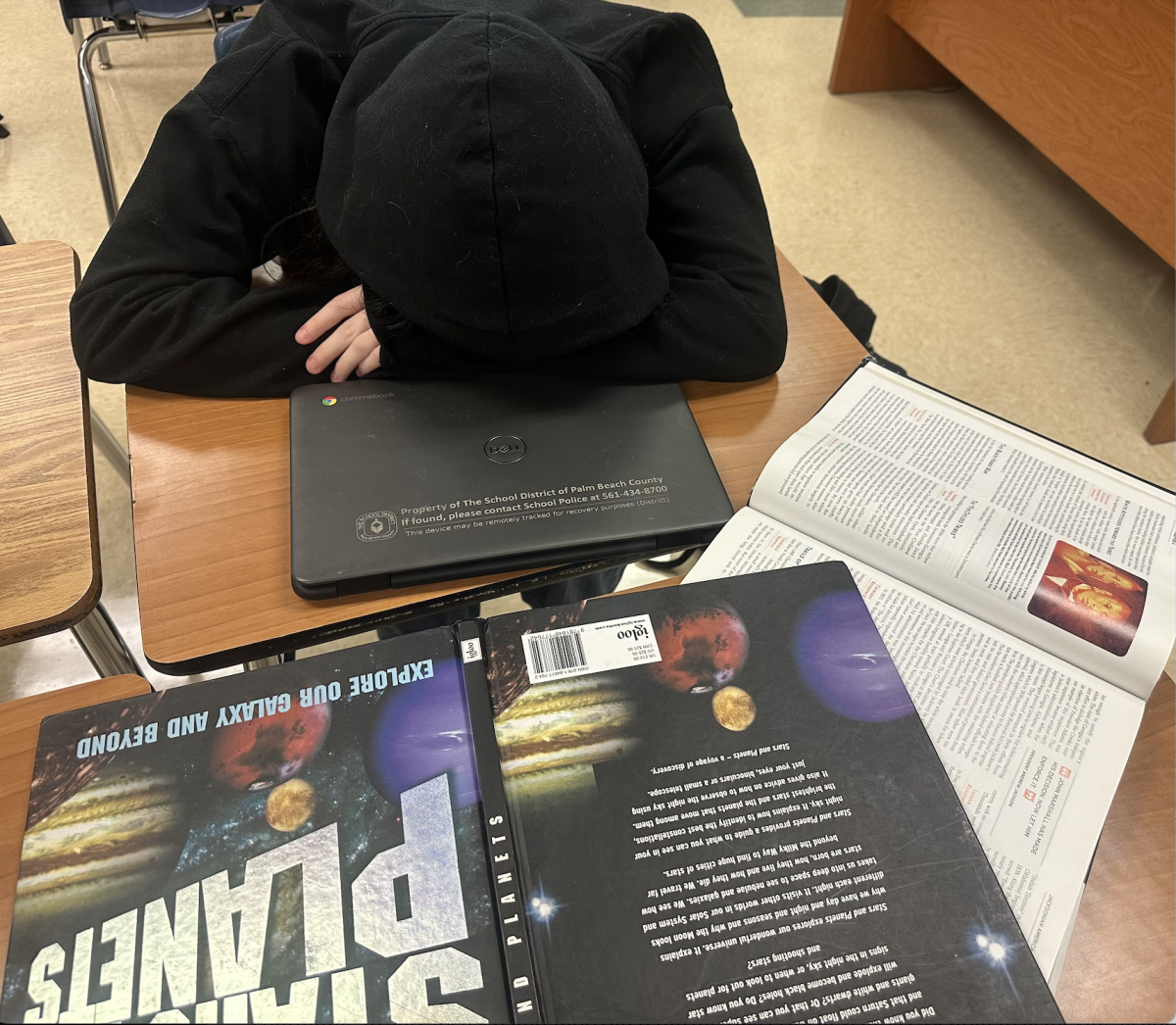

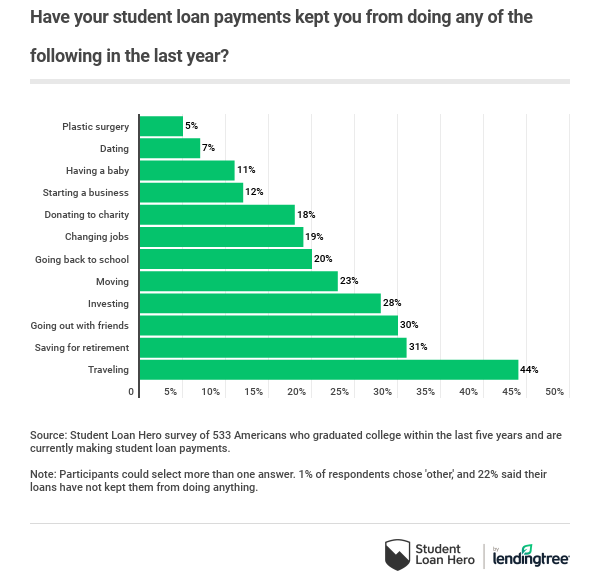

Graduation, especially from college, is an exciting moment. However, it marks another event: student loans activate. The need to pay as soon as college ends is difficult for many, particularly those who do not have a stable, well-paying job, or for those who are in unpaid internships who wish to progress their career to leap into a better position. Student loans halt plans in this case, and most students do not see their impact until after they graduate.

One factor to consider is compound interest. While most student loans charge simple interest (where only the principal amount is paid and interest does not rise due to unpaid interest), especially federal student loans, a few private ones may use compound interest (where more interest is paid over time). Interest may compound on federal loans during the student loan deferment periods (no payments are being made, so the interest increases). Be sure to understand what your loan is, and avoid those with compound interest, for as it grows, so does your loan.

Post graduation, there is a six-month grace period for the majority of federal loans. During this time, it is important to select a payment plan and reach financial stability in your chosen career. Though, if possible, apply for a grant as they are essentially free college money. No repayment is necessary, and there are merit and need-based grants.

Here is a brief overview of the different types of available loans:

- Federal loans are simple to receive for most students with a high school diploma, and they do not usually require a co-signer or good credit. The Free Application for Federal Student Aid (or FAFSA®) must be filled out in order to apply.

- Private loans come from a bank, credit union or an online lender. The student must prove to the lender that they can repay it (such as through a good credit score), so a co-signer is a necessity in the majority of cases (who are responsible if the student does not pay). These loans may be used to cover any costs necessary to attend college. However, they have more rules for borrowers, so federal loans are a better option.

- Stafford loans, which are a part of the William D. Ford Federal Direct Loan Program, are low-interest loans for eligible students to help cover the cost of higher education at a four-year college or university, community college, or trade, career, or technical school, as defined by govloans.gov (an official government site that is perfect for students discovering different loans). Students borrow from the U.S. Department of Education, and both undergraduate and graduate students may apply. They can be subsidized (awarded on the basis of financial need) and unsubsidized (not awarded on the basis of need).

If possible, go for a grant, such as the Federal Pell Grant. It is awarded to those who display exceptional financial need. It does not need to be repaid, and the application to it is free through FAFSA®. For more information, go here.

Currently, there has been an extended pause on payment. Former President Donald Trump and current President Joe Biden instated a pause on student loans and interest (the former moved the date twice and the latter four times). After over two years of relief, August 31, 2022 is said to be the final date. This is a relief for many, particularly due to inflation and the pandemic. While there is pressure to continue the pause, that may not occur, so it is best to be prepared. For soon-to-be high school graduates, this solidifies a precedent in case later events also require a need for government assistance.

For tips on how to pay off student loans, this article may be helpful.

Your donation will support the student journalists of West Boca Raton Community High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Hello! My name is Natasha Kuneff, and I am a senior at West Boca. This is my third year in the Bullseye Newspaper, so writing has been a large part of...